“We thought we were buying the future of edtech. What we got was a barely-working app,

inflated user numbers, and a six-figure loss.”

– A venture capitalist, burned by skipping proper due diligence.

This isn’t a rare story. In fact, investors lose billions every year not because of bad luck — but because they didn’t ask the right questions. If you’ve ever felt unsure about a business deal, you’re not paranoid — you’re smart.

Let’s walk through the due diligence process that separates wishful thinking from smart investing, and see how you can shield yourself from those “we didn’t see this coming” surprises.

What Is Due Diligence? (And Why Most Skip It)

Before we dive into the process, let’s start with the basics.

What is due diligence? It’s the thorough, systematic investigation of a business before you invest in or acquire it. Think of it as a background check on steroids — covering finances, operations, tech infrastructure, people, and even brand perception.

Now here’s the catch…

63% of investors admit they rely on the founder’s charisma during early-stage

deals more than hard data.

This emotional decision-making — especially in tech — leads to overvalued startups, product failures, and compliance nightmares. Due diligence isn’t just a formality. It’s how smart money moves.

Shocking Realities Tech Investors Face Without Due Diligence

Let’s talk facts — not fear-mongering.

🚨 In 2022, a fintech startup in Southeast Asia raised $18M. Later, a due diligence probe found 70% of their “active users” were bots. The VC firm had no idea until after the funds were gone.

🚨 A major US PE firm invested $30M in a cloud HR SaaS. Within 6 months, users started reporting data leaks. Turns out, the source code had never passed a third-party security audit.

🚨 One in every three tech startups misrepresents at least one key metric — be it user growth, revenue, or server uptime.

These aren’t edge cases. They’re happening every month. And if you’re not doing due diligence, you’re walking into these traps blindfolded.

Due Diligence Meaning (Beyond Legal Docs and Balance Sheets)

The true due diligence meaning in tech is much more than reviewing spreadsheets. It’s answering questions like:

- Is the product scalable — or duct-taped?

- Does the founding team have experience — or just buzzwords?

- Are the users real? Are the reviews organic?

- Is the tech stack future-proof or held together by borrowed code?

Investors who take shortcuts often find out too late that the app doesn’t work offline, the IP is under dispute, or the team is more hype than execution.

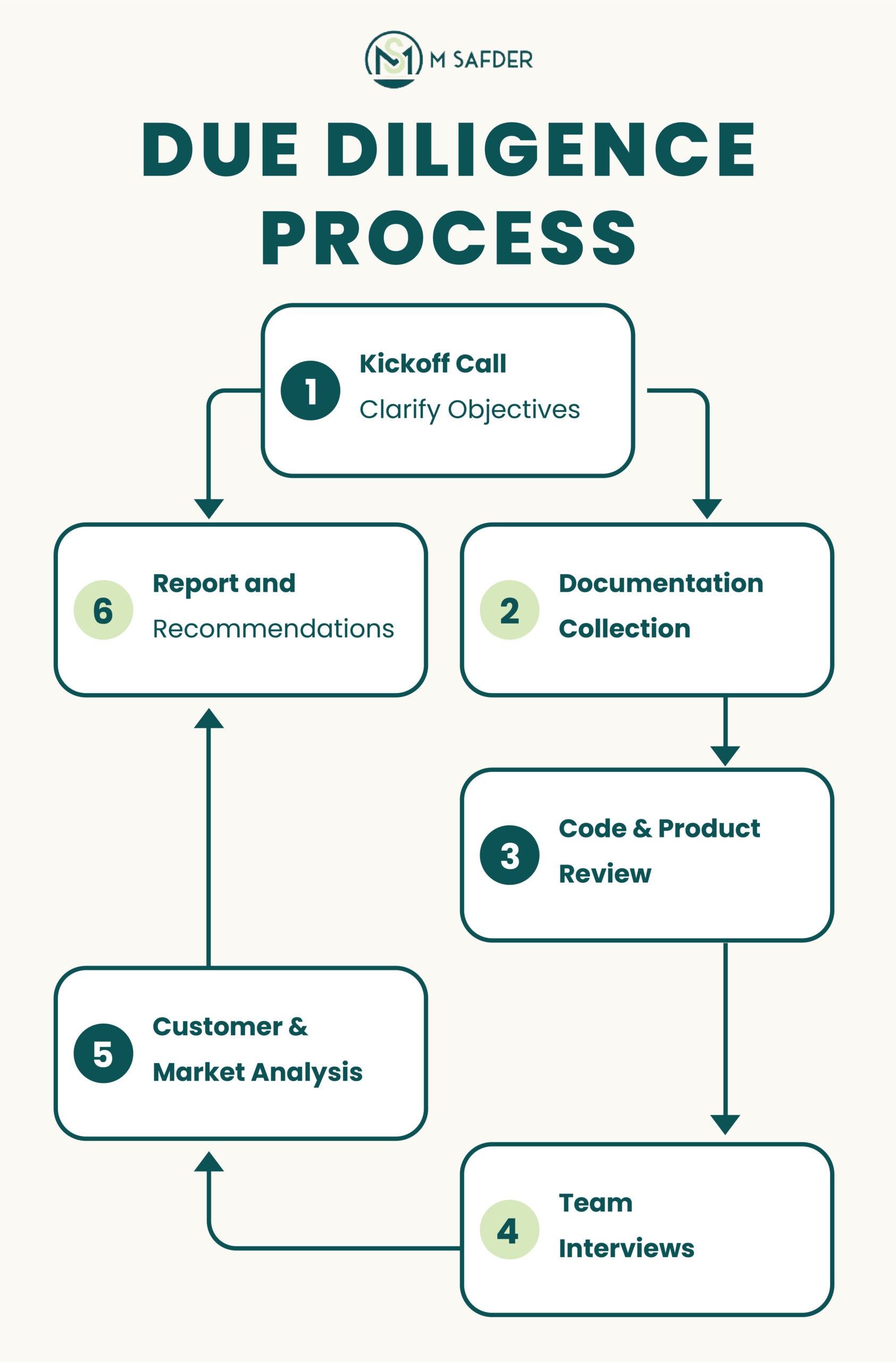

The Due Diligence Process That Protects Your Investment

Here’s a proven step-by-step process that keeps your deals clean and your risk controlled:

1. Kickoff Call — Clarify Objectives

What are you trying to learn? Red flags? Code quality? Financial burn rate? This defines your direction.

2. Documentation Collection

Ask for:

- Financial reports (past 3–5 years)

- Legal documents (IP ownership, contracts)

- Cap table

- Customer list & metrics

- Employee roster & roles

- Product architecture

Red flag: If they stall or avoid sharing — take it seriously.

3. Code & Product Review

Tech due diligence isn’t about asking if it “works.” It’s about:

- Codebase originality (scan for copy/paste from open-source)

- Scalability testing

- Security protocols & GDPR compliance

- Architecture sustainability

- CI/CD processes

Case Study: In 2021, a crypto trading platform failed its audit. 60% of the code was untested. They had 100k users. A quiet disaster waiting to happen.

4. Team Interviews

Talk to CTOs, product managers, customer success leads. Are they aligned? Can they scale with growth?

Tip: Smart investors also speak privately with former employees.

5. Customer & Market Analysis

- What’s churn rate?

- What’s NPS score?

- Is their TAM (total addressable market) real or exaggerated?

- Are there copycats gaining ground?

Pro tip: Look for a high dependency on one or two clients. It signals revenue fragility.

6. Report and Recommendations

Wrap up your findings:

- What are the risks?

- What needs fixing?

- Is the deal worth it at the asking price?

Human Mistakes That Kill Deals — Even After Due Diligence

Even with a great process, some investors get swayed by vision over facts.

- A founder with 300K followers doesn’t mean product-market fit.

- A slick pitch deck doesn’t mean solid backend infrastructure.

- A brand featured in TechCrunch doesn’t mean it’s profitable.

Due diligence works only when you trust the data more than the drama.

How Msafdar Helps You Avoid Deal Regret?

Let me tell you something straight — I’ve seen the pain of buyers who moved too fast. Investors who lost $500k over “we didn’t know.” CEOs who inherited legal messes because no one checked the fine print.

That’s exactly why Msafdar.com offers due diligence services tailored for today’s digital ecosystem.

Here’s how we work differently:

✅ Tech DNA: We don’t just look at code. We analyze if the tech is built to scale, secure, and survive.

✅ People-Powered Insights: We interview the right teams and former partners to spot cultural and leadership issues that kill growth.

✅ Reality-Based Reporting: No fluff. Just the hard truth — in a language you understand.

✅ Risk Scoring: Every deal we vet gets a “deal heatmap” that visually shows which areas are red, yellow, or green.

Whether you’re investing in a healthtech startup, acquiring a SaaS tool, or scaling your own company — you deserve to be 100% sure.

📩 Want us to protect your next investment?

Let’s talk and schedule your confidential call today.

FAQs

❓ What is due diligence?

Due diligence is the process of investigating all important aspects of a company — finances, legal structure, technology, and operations — before investing or acquiring. It reduces risk and prevents bad surprises.

❓ What’s the real due diligence meaning in the tech world?

In tech, it means looking beyond numbers — into the code, team culture, scalability, and IP ownership. It’s about checking if the product can survive rapid growth or a data breach tomorrow.

❓ Can I trust documents shared by the seller?

You can start with them, but never end there. Always verify with third-party reviews, audits, and interviews.

❓ Is due diligence only for big deals?

No. Even angel investors and seed rounds require it. Every dollar counts.

❓ What if I skip tech due diligence?

Best case? You overpay.

Worst case? You acquire a security risk, user backlash, and potential lawsuits.

Don’t skip it. Ever.