No one starts a business thinking they’ll ever have to “fix” it. You plan, you hustle, you give it everything. And for a while, it works. Sales start rolling in. Your team grows. The brand feels alive.

But then something changes.

Maybe it’s a global crisis, a shift in the market, or a few bad decisions that snowball. Suddenly, the accounts are tight. You’re dodging supplier calls. Loans are stacking up. And no matter how hard you push, you’re stuck in a cycle of financial stress that keeps getting louder.

This is where most business owners feel like giving up.

But here’s something they don’t teach you in business school: You don’t always need more money. Sometimes, what you really need is a better structure—something built on the capital restructuring strategies for businesses that are designed to revive, not replace, what you’ve already built.

What Is Capital Restructuring?

In simple terms, capital restructuring is a strategic rebalancing of your company’s debt and equity to align with your current financial needs and future goals. It’s not just a bailout—it’s a blueprint.

This might include:

- Converting high-interest debt into equity

- Refinancing existing loans with better terms

- Issuing new shares or buying back shares

- Selling underperforming assets

- Renegotiating with creditors

For small to medium-sized businesses, these changes can be the difference between slow death and dramatic recovery.

The Fall of a Family Business — And The Comeback They Didn’t See Coming

Let me share the story of Naveed & Sons, a 2nd-generation family business dealing in construction materials in Gujranwala. For over 25 years, they supplied cement, steel, and gravel to builders across Punjab. It was steady, profitable, and well-known in the region.

But when the real estate market slowed down and prices of imports shot up, they hit a wall. Their credit lines were maxed out. Payments from clients were delayed. They had loans on three vehicles, one warehouse, and an expansion they had started just before the downturn.

In six months, their monthly cash flow dropped by 60%. Salaries were delayed. Staff started leaving. Naveed’s sons—young, educated, hopeful—wanted to shut it down.

That’s when they were introduced to Msafdar through a referral from their local tax advisor.

How Msafdar Helped Them Bounce Back?

Here’s what we did—step by step.

- Debt Restructuring Plan: We analyzed their existing loans and helped them consolidate high-interest debts into one manageable, long-term facility under an SME refinancing program.

- Equity Adjustment: One of their sleeping partners was approached to invest further, in exchange for a slightly increased share. That fresh cash flow helped them keep operations running smoothly during recovery.

- Asset Reallocation: Their underused warehouse was leased to a logistics company, bringing in steady monthly income that went straight into repayment.

- Vendor Negotiations: We stepped in to negotiate better credit terms with suppliers, giving them 45 days to pay instead of 15. This small change alone gave them room to breathe.

We introduced a simple, visual dashboard that helped Naveed and his sons track real-time expenses and plan better.

Result? Within 9 months, the business was back in control. They didn’t just survive—they grew leaner, smarter, and more resilient.

Naveed now says, “It wasn’t money we needed. It was direction. Msafdar gave us that.”

Why It Matters: Importance of Capital Restructuring in Business Growth?

Let’s face it—businesses evolve. What worked in Year 1 may no longer work in Year 5.

That’s where capital restructuring steps in. It aligns your capital with your current stage of business. Whether you’re growing fast, entering a downturn, or prepping for a merger, restructuring can give you flexibility and control.

Here’s how it boosts growth:

- Improves cash flow: By reducing debt repayments or interest expenses

- Attracts investors: A cleaner balance sheet looks more attractive to potential investors or partners

- Supports expansion: Allows you to allocate resources toward growth rather than survival

- Improves creditworthiness: Reorganizing your liabilities can improve your credit rating

In short, it clears the path so your business can move forward.

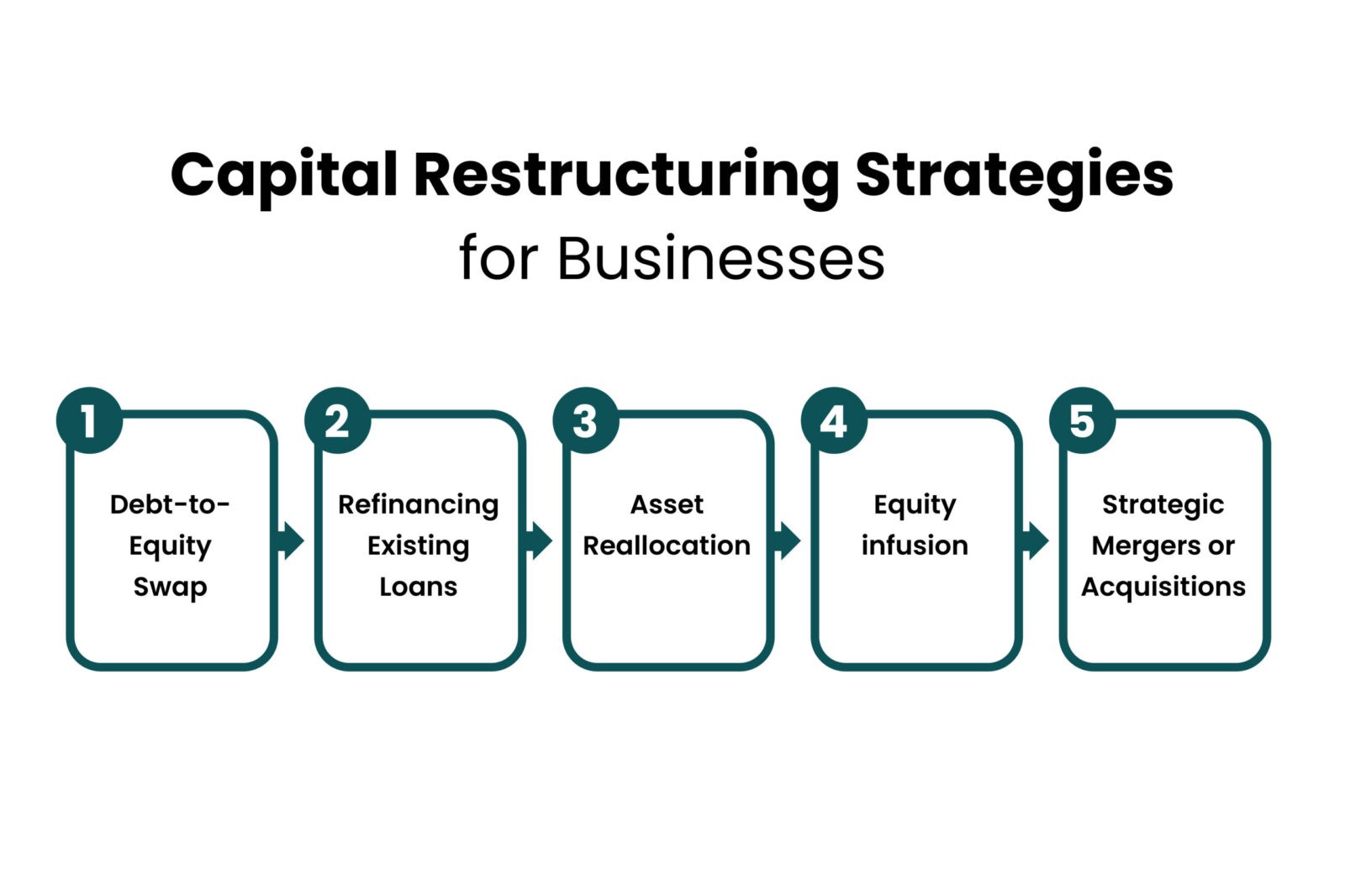

Capital Restructuring Strategies for Businesses

Now let’s dive into the capital restructuring strategies for businesses that have proven results.

1. Debt-to-Equity Swap

This is when a portion of your loans is converted into equity shares. While it reduces debt pressure, it does dilute ownership—so it’s best used when you have willing partners or investors who see long-term potential.

2. Refinancing Existing Loans

Approach banks or NBFCs to restructure your loans under better terms. Maybe you switch from a 3-year loan to a 7-year one, reducing your monthly payment by half.

3. Asset Reallocation

Sell off non-core or underperforming assets to repay loans or free up capital for expansion. Many businesses hold on to properties, outdated machinery, or even unused vehicles—convert them into liquidity.

4. Equity Infusion

Bring in new partners or investors who can inject funds into the business in exchange for equity. This gives you the fuel to grow without increasing your debt burden.

5. Strategic Mergers or Acquisitions

Partnering with another firm or absorbing a smaller player can sometimes be more cost-effective than organic growth. Plus, it enhances market position and investor confidence.

Each strategy must be tailored. The right move for one business may not suit another. That’s why seeking expert advice is key.

Tips for Managing Debt Through Capital Restructuring

Managing debt is often the first motivator behind restructuring. Here are some real-world, actionable tips:

- List all existing loans and their terms (interest rate, tenure, EMI, etc.)

- Prioritize high-interest or short-term debt for action

- Don’t hesitate to negotiate with lenders—especially if you have a solid repayment plan

- Avoid new loans unless they directly improve cash flow or operational capacity

- Maintain a transparent conversation with stakeholders during the restructuring process

Using these tips for managing debt through capital restructuring, businesses not only reduce financial stress but also regain confidence and credibility.

How Capital Restructuring Improves Financial Performance?

Let’s say your monthly revenue is Rs. 10 million. Your loan repayments, salaries, and fixed costs eat up Rs. 9 million. You’re left with crumbs for growth—or even stability.

Now imagine restructuring reduces your debt burden by 30%. That’s Rs. 3 million saved every month. Suddenly, you have money for hiring, marketing, R&D, or even building a buffer fund.

That’s how capital restructuring improves financial performance: by creating financial room to reinvest in the business.

Effective Corporate Restructuring Solutions for Small Businesses

Small businesses often assume that restructuring is only for large corporations. Not true. In fact, small businesses benefit even more—because they feel financial stress faster.

Effective corporate restructuring solutions for small businesses may include:

- Partner buy-ins to reduce individual capital stress

- Local refinancing through SME support programs

- Renegotiation with local suppliers for payment flexibility

- Micro-equity rounds within trusted investor circles

Even simple steps like deferring director salaries or leasing instead of owning equipment can make a big difference.

How Msafdar Can Help?

Navigating financial restructuring isn’t just about spreadsheets. It’s about experience, trust, and knowing what works in the local market.

At Msafdar, we’ve helped SMEs, startups, and family-owned businesses across Pakistan redefine their financial strategy—not just to survive, but to thrive.

Our tailored approach includes:

- Deep-dive financial analysis

- Debt vs. equity evaluation

- Liaising with banks and lenders

- Investor matchmaking and equity solutions

- End-to-end restructuring implementation

Whether your business is stuck or scaling, we offer the capital restructuring strategies for businesses designed for long-term success.

📞 Ready to transform your balance sheet and your business future? Let’s talk.

FAQs

Q1: Is capital restructuring only for failing businesses?

Not at all. It’s also used by growing businesses to free up capital, improve investor appeal, or prepare for major expansion.

Q2: Will I lose control of my business if I restructure?

Only if you choose equity-heavy restructuring without strategic planning. With the right balance, you retain control while improving performance.

Q3: How long does a restructuring process take?

It depends on complexity, but most plans can be developed within 2–4 weeks and implemented over 3–6 months.

Q4: Can I restructure my capital without legal complications?

Yes—with expert advisory and proper documentation, restructuring is 100% legal, compliant, and beneficial.

Q5: Does restructuring affect my business’s market reputation?

In fact, many businesses see a boost in credibility when they openly improve their financial structure.